Ready to Discuss Bankruptcy Discharge? Contact Us Today for Professional Assistance

Ready to Discuss Bankruptcy Discharge? Contact Us Today for Professional Assistance

Blog Article

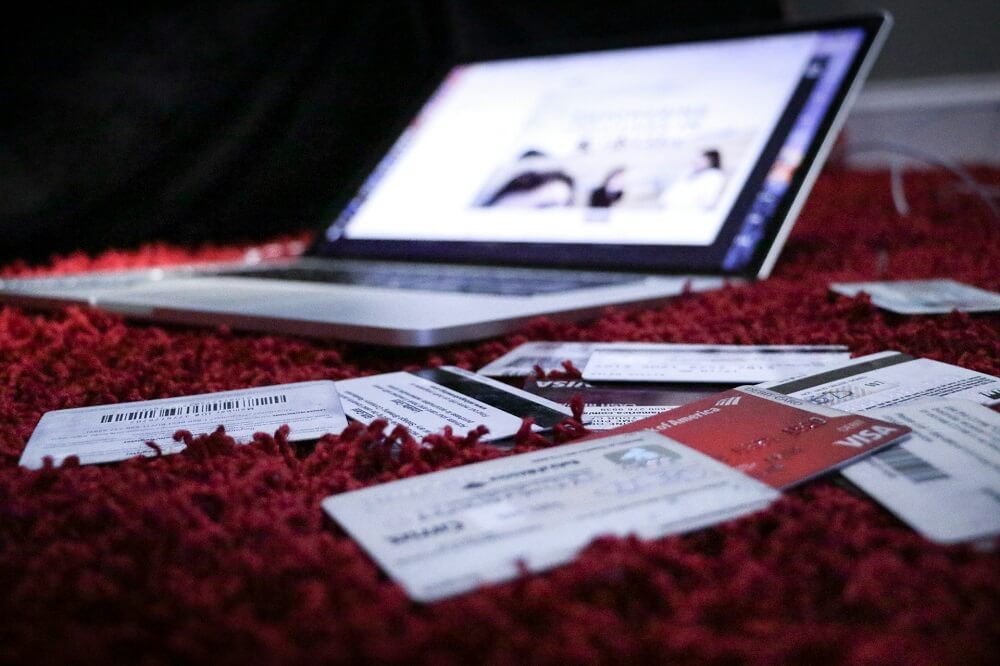

Charting the Course: Opportunities for Credit Score Card Gain Access To After Personal Bankruptcy Discharge

Navigating the globe of bank card access post-bankruptcy discharge can be an overwhelming task for people aiming to reconstruct their financial standing. The procedure involves tactical planning, comprehending credit history complexities, and checking out numerous alternatives available to those in this particular situation. From safeguarded bank card as a tipping rock to potential courses bring about unsafe credit score chances, the journey towards re-establishing creditworthiness needs cautious consideration and educated decision-making. Join us as we discover the opportunities and methods that can lead the way for people seeking to regain accessibility to charge card after dealing with bankruptcy discharge.

Understanding Credit Report Basics

Recognizing the fundamental principles of credit rating is necessary for people seeking to navigate the intricacies of economic decision-making post-bankruptcy discharge. A credit report is a mathematical depiction of a person's creditworthiness, suggesting to loan providers the degree of risk connected with prolonging credit. A number of variables contribute to the calculation of a credit rating, consisting of payment history, amounts owed, size of credit report, brand-new credit, and sorts of credit report made use of. Settlement background holds substantial weight in identifying a credit rating, as it shows a person's capacity to make prompt repayments on outstanding financial debts. The amount owed about readily available credit scores, also recognized as credit score application, is an additional essential element affecting credit rating. In addition, the length of credit report showcases a person's experience managing credit scores with time. Comprehending these vital parts of credit report empowers individuals to make enlightened financial choices, rebuild their credit report post-bankruptcy, and work towards achieving a healthier financial future.

Safe Credit Score Cards Explained

Protected credit rating cards supply a valuable financial tool for people aiming to restore their debt background adhering to a bankruptcy discharge. These cards require a safety deposit, which commonly figures out the credit history limit. By utilizing a safeguarded credit history card sensibly, cardholders can show their creditworthiness to possible lending institutions and gradually enhance their credit rating.

Among the crucial advantages of safeguarded charge card is that they are more obtainable to people with a restricted credit rating or a ruined credit history (contact us today). Since the credit restriction is protected by a down payment, companies are a lot more happy to approve applicants that might not receive traditional unprotected credit cards

It is essential for people considering a safeguarded credit score card to choose a trustworthy issuer that reports to the significant credit score bureaus. This coverage is important for constructing a favorable credit rating and increasing credit rating in time. Additionally, accountable use of a secured bank card entails making prompt payments and keeping equilibriums reduced to prevent accumulating financial obligation.

Bank Card Options for Restoring

When looking for to reconstruct credit report after bankruptcy, discovering various credit rating card choices tailored to individuals in this economic situation can be advantageous. Safe credit scores cards are a preferred option for those looking to rebuild their credit scores. An additional alternative is coming to be an accredited user on a person else's credit report card, enabling individuals to piggyback off their debt history and potentially boost their own rating.

Just How to Get Approved For Unsecured Cards

To qualify for unsafe bank card post-bankruptcy, individuals need to demonstrate enhanced credit have a peek at this site reliability via liable monetary monitoring and a background of on-time settlements. One of the key actions to receive unsafe credit cards after bankruptcy is to continually pay costs promptly. Prompt repayments display obligation and dependability to potential financial institutions. Keeping low credit score card balances and staying clear of accumulating high degrees of financial obligation post-bankruptcy likewise boosts creditworthiness. Checking credit score reports regularly for any kind of errors and challenging errors can better Extra resources enhance credit rating, making individuals extra appealing to charge card providers. In addition, individuals can think about obtaining a secured charge card to restore credit. Secured bank card require a cash down payment as security, which reduces the danger for the issuer and enables people to demonstrate accountable credit scores card usage. In time, responsible economic routines and a positive credit report can result in certification for unprotected bank card with far better terms and rewards, assisting individuals reconstruct their monetary standing post-bankruptcy.

Tips for Liable Charge Card Use

Structure on the structure of enhanced credit reliability developed via responsible financial administration, individuals can enhance their overall economic health by applying crucial ideas for accountable charge card use. Firstly, it is vital to pay the full declaration equilibrium promptly each month to stay clear of building up high-interest charges. Establishing up automatic settlements or pointers can help guarantee prompt repayments. Secondly, tracking costs by consistently checking charge card declarations can avoid overspending and help determine any kind of unapproved purchases immediately. Furthermore, maintaining a reduced credit report usage ratio, ideally below 30%, shows accountable debt use and can favorably impact credit history. Preventing cash money advances, which commonly include high costs and interest prices, is additionally a good idea. contact us today. Last but not least, abstaining from opening several brand-new charge card accounts within a short duration directory can prevent possible credit history damages and too much financial obligation build-up. By sticking to these tips, individuals can utilize bank card effectively to rebuild their financial standing post-bankruptcy.

Verdict

Finally, people that have actually submitted for personal bankruptcy can still access credit scores cards via numerous options such as secured credit scores cards and rebuilding credit scores. By recognizing credit rating rating fundamentals, getting approved for unsafe cards, and exercising responsible charge card use, individuals can progressively rebuild their creditworthiness. It is essential for individuals to very carefully consider their economic circumstance and make informed decisions to improve their credit history standing after insolvency discharge.

Several variables contribute to the computation of a credit report score, consisting of settlement history, amounts owed, size of credit rating background, new credit scores, and kinds of credit rating made use of. The quantity owed family member to readily available credit scores, additionally known as credit score utilization, is one more critical element affecting credit rating ratings. Monitoring credit records frequently for any kind of mistakes and challenging errors can further enhance credit report ratings, making individuals extra eye-catching to credit history card companies. Furthermore, maintaining a reduced credit rating application ratio, ideally listed below 30%, shows liable credit score usage and can positively impact debt scores.In verdict, people who have filed for personal bankruptcy can still access credit cards through numerous options such as protected credit score cards and restoring credit.

Report this page